Despite decades of international development efforts, many governments still struggle to fund basic services for their citizens - paying more on servicing external debt than on health or education budgets. Cuts in official development assistance will not help us close a staggering $4 trillion financing gap to meet the Sustainable Development Goals. Country representatives will gather in Spain in a few months for the Fourth Financing for Development Conference (FFD4) to wrestle with this challenge and set a financing agenda for the next decade. One hope is that donors agree to scale investment in one of our most powerful tools for development - equitable domestic revenue mobilization (DRM).

As negotiations began in earnest for FFD4 at the 3rd session of the Preparatory Committee meetings in New York recently, TAI was delighted to partner with the Permanent Mission of The Gambia to the UN, Norad, and Addis Tax Initiative (ATI) on a formal side event on Domestic Revenue Mobilisation (DRM) as a Cornerstone for Sustainable Development Finance. Read here for the full account of that wide-ranging discussion.

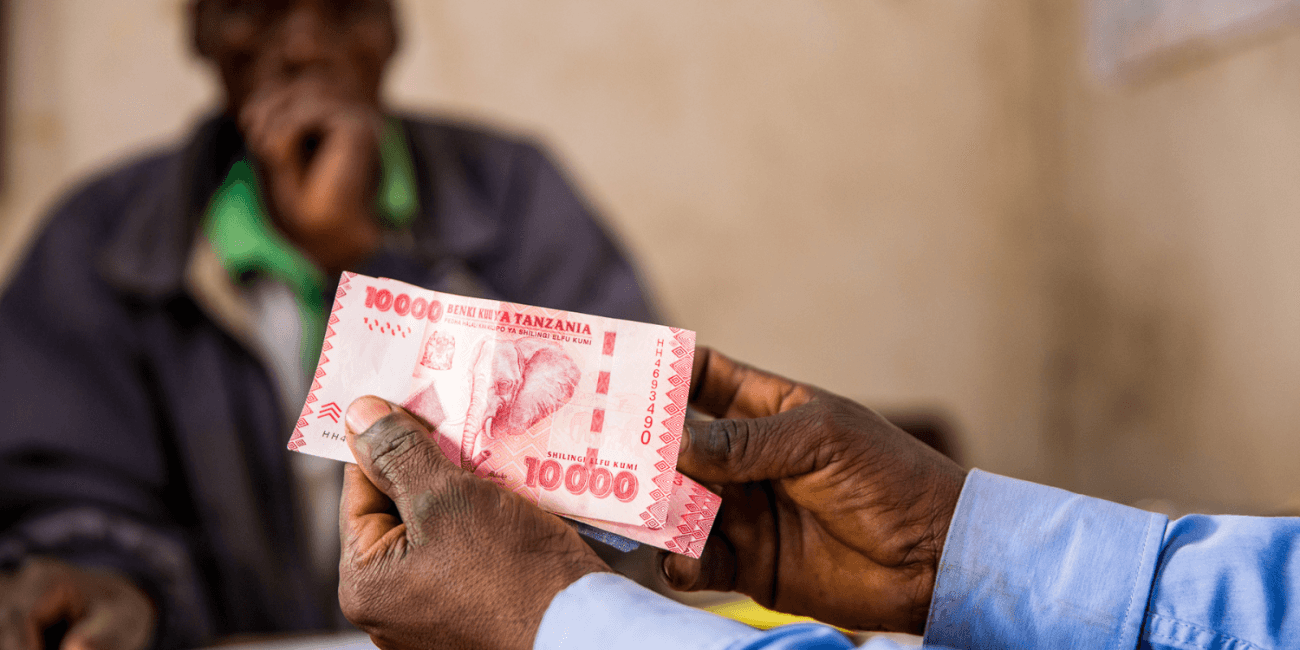

Core to our message was that investment in fair and effective tax systems is money well spent - both for raising funds for climate and development action, but also because accountable fiscal systems are a bedrock for democratic societies and sustainability.

Currently, the donor community does not invest enough in DRM and from what it does spend, most funds take the form of technical assistance directly to government. Civil society organizations, parliaments, and oversight bodies - crucial players in ensuring tax systems work effectively and fairly - receive inadequate support for their vital role in fiscal governance.

This inadequacy becomes even more striking when considering the broader context of development assistance. While DRM is widely acknowledged as crucial for sustainable development, it represents only a tiny fraction of Official Development Assistance (ODA). In 2021, DRM assistance was $574.4 million out of an ODA total of $185.9 billion. Support to non-state actors is again just a small fraction of the DRM spending - our estimates suggest just $55 million committed over the past five years for tax justice specifically.

However, investment in tax gets a high return - as a packed house heard for another session in New York featuring the Tax Inspectors Without Borders program. This sends in expert tax auditors to help country revenue administrations strengthen their audit capacity and has helped countries assess over $6 billion in additional tax based on their most recent annual report.

There is an opportunity for government and philanthropic government donors to come together in strengthening tax support, so countries can meet their development objectives and reduce dependency on vulnerable foreign aid. The last Financing for Development conference in Addis Ababa in 2015 saw the welcome launch of ATI - a multi-stakeholder partnership, fostering collective action to improve tax systems - and a commitment of participating donor countries to double their DRM support by 2020.

That commitment has made a difference but we now understand that the doubling of support was from a very low base. Today more ambition is needed. Let’s renew the commitment to double for the decade ahead.

By the time FFD4 wraps up in early July, countries need to have agreed to specific, measurable ambitious commitments to strengthen their tax bases, including through international cooperation. At the same time, we need to work toward a parallel commitment from the donor community for specific, ambitious DRM support to the countries that most need it. The question isn't whether we can afford to invest more in fair, effective tax systems and fiscal accountability - it's whether we can afford not to, given the massive development challenges facing our global community.