Dear Readers,

This week we range from advances in environmental disclosures, to overdue commentary on dirty money to pharmaceutical conflicts of interest to a welcome trend in philanthropic giving.

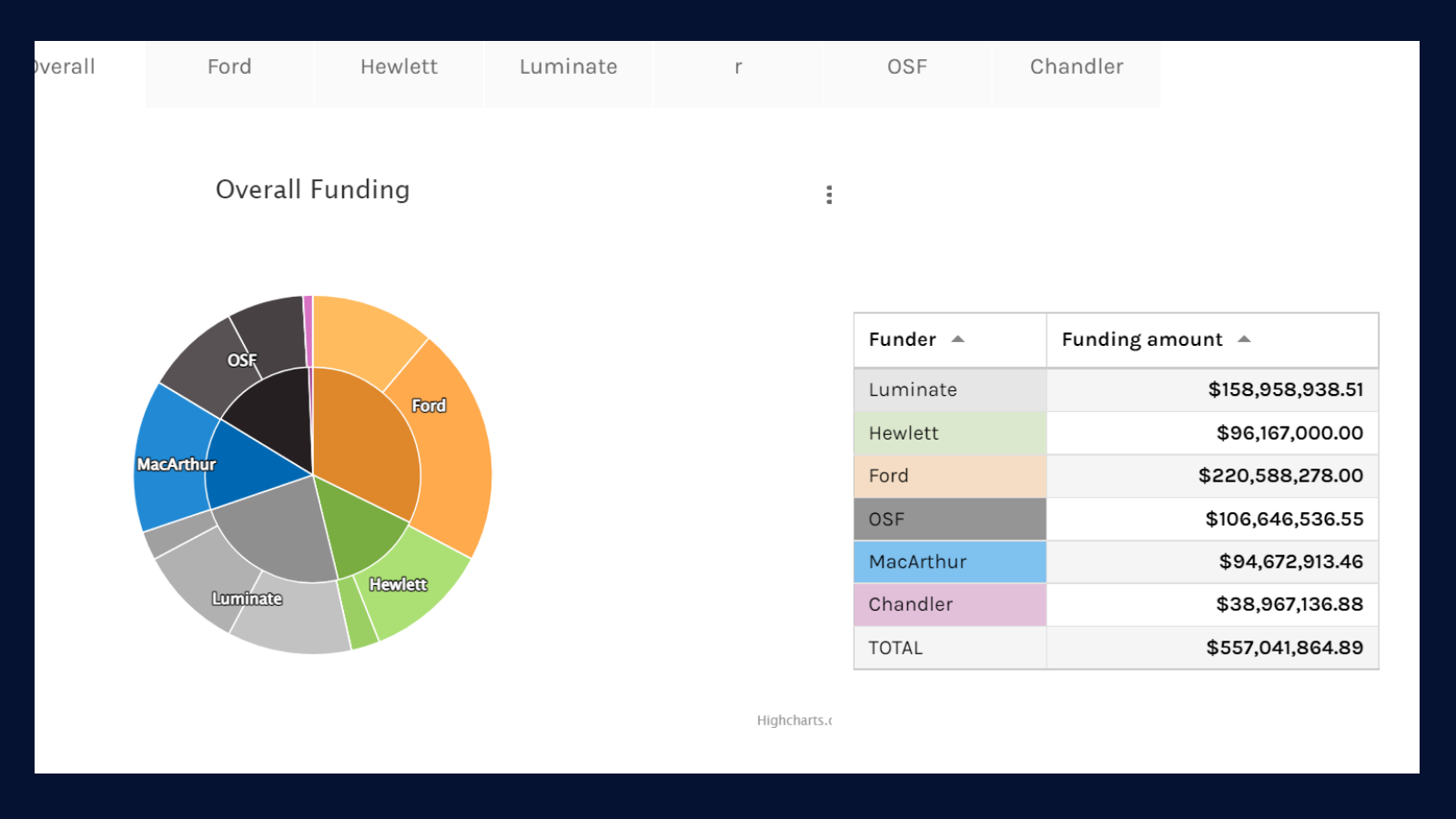

We also wanted to share with you our updated TAI’s grants database, covering our member’s TPA-related grants active in 2021. We are working on a short series of blogs related funding trends, both of TAI and more broadly. Here is the first!

We take this opportunity to thank you for your readership and commitment to transparency, participation and accountability!

Michael Jarvis,

TAI´s Executive Director

Progress in the Americas: Chile, Ecuador, US Image Credit: BBC

Image Credit: BBC

Let’s start with some good news. Gabriel Boric, Chile’s new President, has signed the United Nations Escazu Agreement, including greater protections for environmental defenders. While Chile had been part of the negotiations, the country had not signed the agreement until now citing potential legal issues.

Ecuador is the first Latin American country to join the Fisheries Transparency Initiative, a global multi-stakeholder partnership focused on increasing transparency and collaboration in marine fisheries management.

Last week we featured an explainer on why financial regulators care about climate disclosures. Now, the U.S. Securities and Exchange Commission has published its draft rule to require public companies to disclose their climate risks and greenhouse gas emissions. Last Monday, Chair Gary Gensler stated that “Our core bargain from the 1930s is that investors get to decide which risks to take, as long as public companies provide full and fair disclosure and are truthful in those disclosures. That principle applies equally to our environmental-related disclosures.”

We need more than just green: carbon taxes, public budgets, climate corruption

A new study from Philipp Gray and Luiz Garcis argues a global carbon tax and dividend scheme could transform global climate and economic justice. Sub-Saharan Africa and South Asia would see some of the biggest increases in national income per capita.

Is your country’s budget addressing climate change? The Climate Finance Group of Latin America and the Caribbean together with International Budget Partnership developed a guide to analyze the public budget on climate action. The guide includes a review of different methodologies for analyzing and identifying climate finance-related expenditures and a step-by step methodology for climate budget analysis.

How to curb risks of losing public monies to corruption in climate financing? Experts demand that governments put corruption eradication on the table at global climate events, such as the UN Climate Change Conference.

Meantime, the fossil fuel industry is one of the few beneficiaries of the current Ukraine crisis driving up prices. That extends to Russian state-owned firms. Even if US and European oil firms extricate themselves from partnerships with Russian groups, NGOs estimate those partnership have contributed as much as $100 billion to Kremlin coffers since 2014.

Long read of the week – pharmaceutical transparency

How can countries create cultures of transparency, accountability, and trust in the pharmaceutical sector? Take a peek at the conclusions of a recent study on conflict of interest policies and practices in the public pharmaceutical sector in ten countries in South-East Asia between September 2020 and March 2021.

Calls for action: fighting illicit financial flows, Canada goes public and dodgy deals

Commentators are waking up to the need for action on ending financial secrecy. Gillian Tett says we finally have a chance to overcome our “social silence” that tolerates anonymous shell companies, James Boyce and Leonce Ndikumana lay out ways for policymakers to end our enabling of dirty money flows, and Daron Acemoglu explains that “the West’s accommodation of dark money has accelerated the trend toward more opaque ownership structures and complex trusts aimed at evading taxes, supported by a massive infrastructure of bankers, accountants, and lawyers around the world” and calls for action to curtail tax evasion.

Even the UK’s Mirror tabloid got in on the act of calling for reform of the UK’s Companies House and action on fraudulent “cloning” of companies.

In one sign of action, President Trudeau announced that his government will implement a public beneficial ownership registry by the end of 2023 – a big win for civil society advocates. For context and to see how concerted, coordinated efforts – with funder support – to drive beneficial ownership transparency at the provincial and federal level led to several important outcomes, see TAI’s case study on Canada.

Similar reforms might help in Zimbabwe, where an investigation from The Sentry finds that the country’s central bank paid an estimated $93 million in possibly unlawful payments to the companies of presidential advisor and high-profile tycoon Kudakwashe Tagwirei as part of a major government agriculture program.

Contrasting visions – debt transparency urgency, an Asia moment and hopes for a transparent and fair global order

Image Source: WTO

Image Source: WTO

Greater transparency is essential to prevent a new sovereign debt crisis argue William Rhodes and John Lipsky – “reforms must reach beyond simple data transparency to greater clarity regarding the entire restructuring process.”

China will play a critical role in resolving the debt crisis and bringing greater transparency. What will their leadership look like? Interesting to read the statement of China’s foreign policy lead on a trip to India. He argued that “This year and the next will witness “Asia Moment” in global governance… If China and India speak with one voice, the whole world will listen.” He urged the two countries to, “join hands… and inject more positive energy into improving global governance.”

With her own view of global governance needs, at the inaugural event of the WTO’s Presidential Lecture Series, Barbados’s Prime Minister called for a new global order that is “transparent and fair and rooted in moral legitimacy.”

Gift-making, not grant-making

Explore the latest 465 non-profits that received MacKenzie Scott’s $3,863,125,000 in the past 9 months alone. Read her latest essay, in which she notes “as always our aim has been to support the needs of underrepresented people from groups of all kinds. The cause of equity has no sides.”

Interesting to see so many intermediary funders working internationally in this round of funding, including the Fund for Global Human Rights, the Climate Justice Resilience Fund, and Mama Cash.

Other Stories

Ukraine Shows Why the G20 Anti-Corruption Agenda Is More Important than Ever

A Cameroon-born entrepreneur is trying to make African soccer more transparent

Legislation seeks to block lengthy gag orders on tech firms after government surveillance

Exposing The Say-Do Gap for Racial Justice Giving: WPI’s New Report (philanthropywomen.org)

|