The challenges of tax losses, high debt, climate change, and austerity

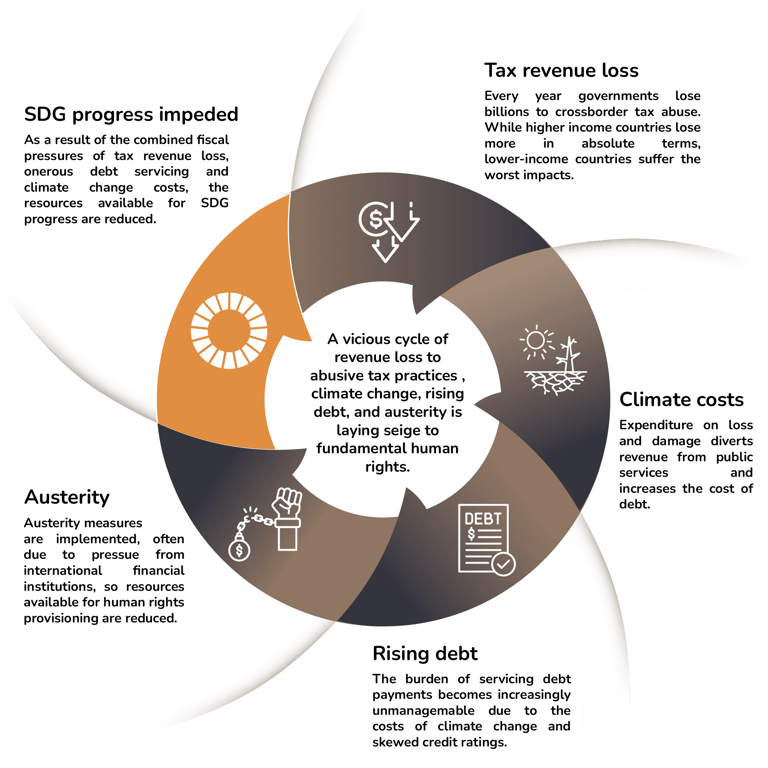

Governments in the Global South face unprecedented financial pressure. A combination of widespread tax abuse, exposure to external shocks, particularly climate-related shocks, and record-high external debt repayments has eroded their fiscal space. Austerity measures implemented as a response to these pressures have undermined public services and impeded progress towards the Sustainable Development Goals (SDGs). In 2024, the UN Secretary-General warned that only a small fraction of the SDGs is on track and that they represented “a promise in peril.” (Figure 1)

Figure 1. Multiple pressures are negatively impacting on the SDGs and perpetuating a vicious cycle

Source: GRADE, University of St. Andrews & University of Leicester, 2025

It’s easy to tune out when confronted with large numbers: the world loses US$492 billion to tax abuse every year; African countries will pay over US$88 billion in external debt service in 2025; and since 2000, the world has suffered at least US$2.8 trillion in loss and damage from climate change, most of it driven by the emissions of wealthier countries. The reality is that billions are flowing out of the Global South every year, despite its enormous SDG financing needs. The United Nations Conference on Trade and Development (UNCTAD) estimates that the SDG financing gap stands at over US$4 trillion annually.

What if much more of this financing could be made available? What would be the impact on the SDGs? Inspired by this question, researchers at the University of St Andrews and the University of Leicester in the UK developed the Government Revenue and Development Estimations – (GRADE model) – a tool to realistically estimate how increases in government revenues translate into development impacts, such as how many more children could live to celebrate their fifth birthday, attend school, and thrive in adulthood.

How it works: GRADE interprets how changes in government revenue impact development, given governance conditions and development levels in a country

We’ve all seen the catchy briefs: if multinational mining corporation A stops artificially shifting profits away from country B, then country B will be able to pay thousands more nurses and teachers. Alternatively, if external debt repayments were reduced, governments would similarly be able to vaccinate thousands more children. This might give us pause for thought, but we know it’s not realistic. No government will suddenly take all the recouped revenue and spend it on health or education.

What makes GRADE unique is that it takes into account a country’s governance conditions and development levels and realistically assumes that governments will use additional revenue in line with past spending patterns.

The basic premise of the model is as follows: in very low-income countries, increases in government revenue have a more limited impact on development outcomes due to weaker governance systems. However, as economies grow, even modest revenue gains can lead to significant improvements in welfare, creating a positive feedback loop where rising incomes contribute to better governance, which in turn enhances development outcomes. Finally, as an economy becomes more developed, many welfare measures reach a saturation point, where it becomes very expensive to bring about further improvements.

Thus, the model doesn’t follow a simple linear path but an S-shaped curve that incorporates governance conditions and income levels in a country (Figure 2). This means that when all things are equal, the same increase in government revenue will have a different impact in different countries.

Figure 2. The relationship between government revenue and coverage of SDG indicators

Source: GRADE, University of St. Andrews & University of Leicester, 2025 (Created with BioRender.com.)

GRADE works with three decades of data from 196 countries, including government revenue, governance, and human development, to model potential scenarios from increased revenue, such as expected increases in the number of children who live past five years, mothers who survive childbirth, and people who could have access to clean water, good sanitation, and electricity. The underlying datasets for the model are the United Nations University World Institute for Development Economics Research (UNU WIDER) Government Revenue Dataset, the World Bank’s Worldwide Governance Indicators, and the World Bank’s World Development Indicators.

The findings

Tax abuse, tax exemptions, and external debt service all drain governments' revenue. GRADE can be used to understand the negative impact these outflows have on SDG progress in individual countries. These can then be aggregated to provide estimations for regions or income groupings, to model what happens when external debt service is reduced, tax abuses curbed, or tax exemptions minimised.

For example, GRADE shows that in sub-Saharan Africa, if 26 countries had additional revenues equivalent to those foregone through tax exemptions, an additional 13 million people would use clean water and 23 million would have access to basic sanitation. An additional 4.8 million children would be in school every day and 97,000 more children would survive past their fifth birthday. The model also shows that additional revenue improves governance, reduces corruption, and increases government effectiveness.

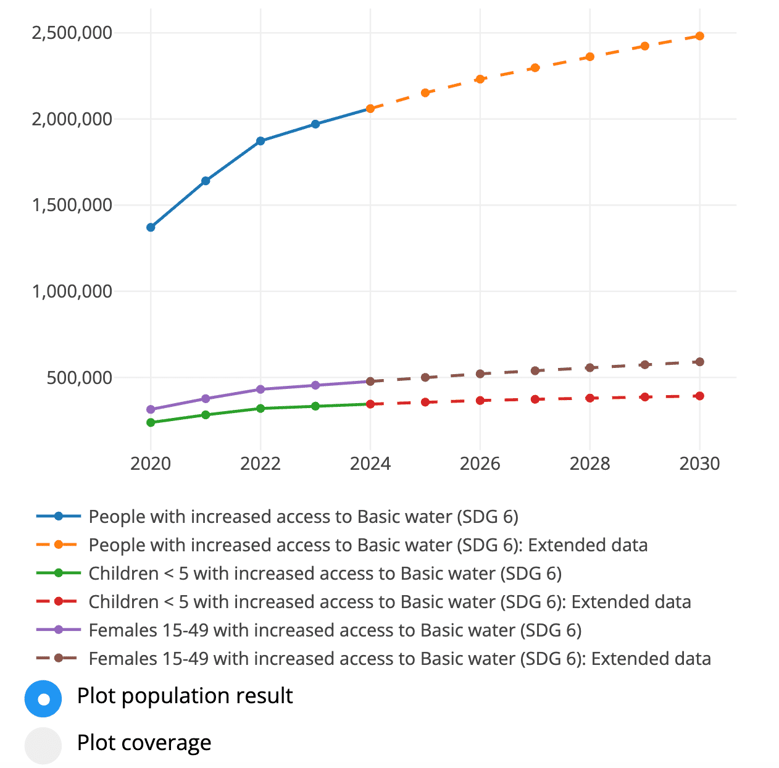

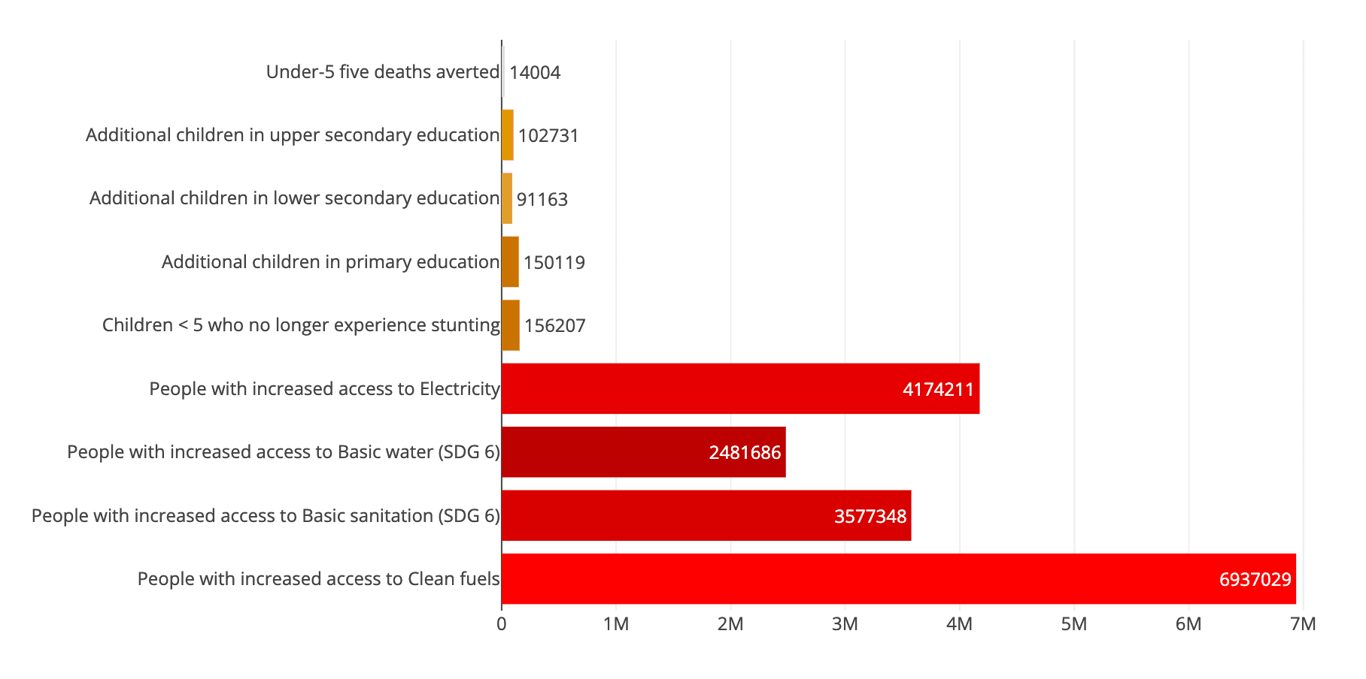

Another example is shown in Figure 3 for Angola. This shows the long-run impact on access to basic water between 2020 and 2030, and the final impact on other SDG indicators by 2030, if external debt service is reduced from 64.7% (the current level) to 15% of government revenue. It shows that an additional 2.48 million people would have access to water, an additional 4 million would access electricity, 7 million clean fuels to cook, and 14,000 additional children would survive past their fifth birthday.

Angola: Projection Results

Angola: Final Effects in 2030

Figure 3. The impact of reducing external debt service in Angola on basic water over time and on multiple SDG indicators

Source: GRADE Model, 2025

GRADE can also be used to analyse the impact of tax paid by multinational corporations to host countries. Corporate income tax constitutes 18.8% of tax revenue in African countries compared to 10% in OECD countries. GRADE can be used to show how corporate contributions to public finances help drive SDG progress, as demonstrated in this case study on Vodafone. However, many multinational corporations artificially shift profits from the country where economic activity takes place, to low (or no) tax jurisdictions to minimise their tax contributions. GRADE shows the potential for the SDGs if such cross-border tax abuse is curtailed.

In 2015, the ground-breaking High-Level Panel on Illicit Financial Flows from Africa, led by former South African President Thabo Mbeki, catalysed a continent-wide movement to “Stop the Bleeding.” In the report, President Mbeki pointed to the bitter irony that Africa is a “net creditor to the rest of the world” and argued that reducing illicit financial flows from Africa was vital for the goal of eradicating poverty on the continent. The report cited a paper by the team which showed the effects of illicit financial flows on under-five mortality rates, finding that there would have been large reductions in child mortality in Africa if these flows were curtailed. GRADE analyses have also been used by international non-governmental organizations in their research and submissions to the United Nations (UN) Secretary General’s tax report and UN human rights bodies.

We invite colleagues to experiment with the GRADE Model here. We’ve also produced a practical user guide. GRADE is open access and free to use. We’re interested in how you use the tool and would love to hear from you, including your suggestions on development indicators we can incorporate into future iterations of the model. We’re also keen to explore collaborations with interested organisations and institutions leveraging the GRADE Model.

GRADE can be a powerful tool to support both national and international advocacy. It makes a positive case for redoubling efforts to support the poorest countries to mobilize additional revenues from all sources – particularly those that can most afford it. GRADE shows very clearly the positive and transformational impact this could have on the lives of millions of people worldwide. With the deadline to achieve the SDGs only five years away and progress so significantly off-track, this couldn’t be more urgent.

If you want to use GRADE in your work, please get in touch with the team. We can walk through the model or collaborate with you to provide analyses to advocate for changes to bolster government revenue and improve the lives of millions worldwide.

Interested in learning more about how increases in domestic public revenue impact development outcomes, considering differences in governance levels? Join the University of St. Andrews, the University of Leicester, and the Trust, Accountability, and Inclusion Collaborative (TAI) for a webinar that will demonstrate how to use the GRADE tool and feature insights from organizations that have applied it in their work. REGISTER HERE!